Our Investments

TECT Community Trust’s total assets as at 31 March 2025 were valued at $936M.

TECT administers a diverse portfolio of investments which includes a range of national and international investments.

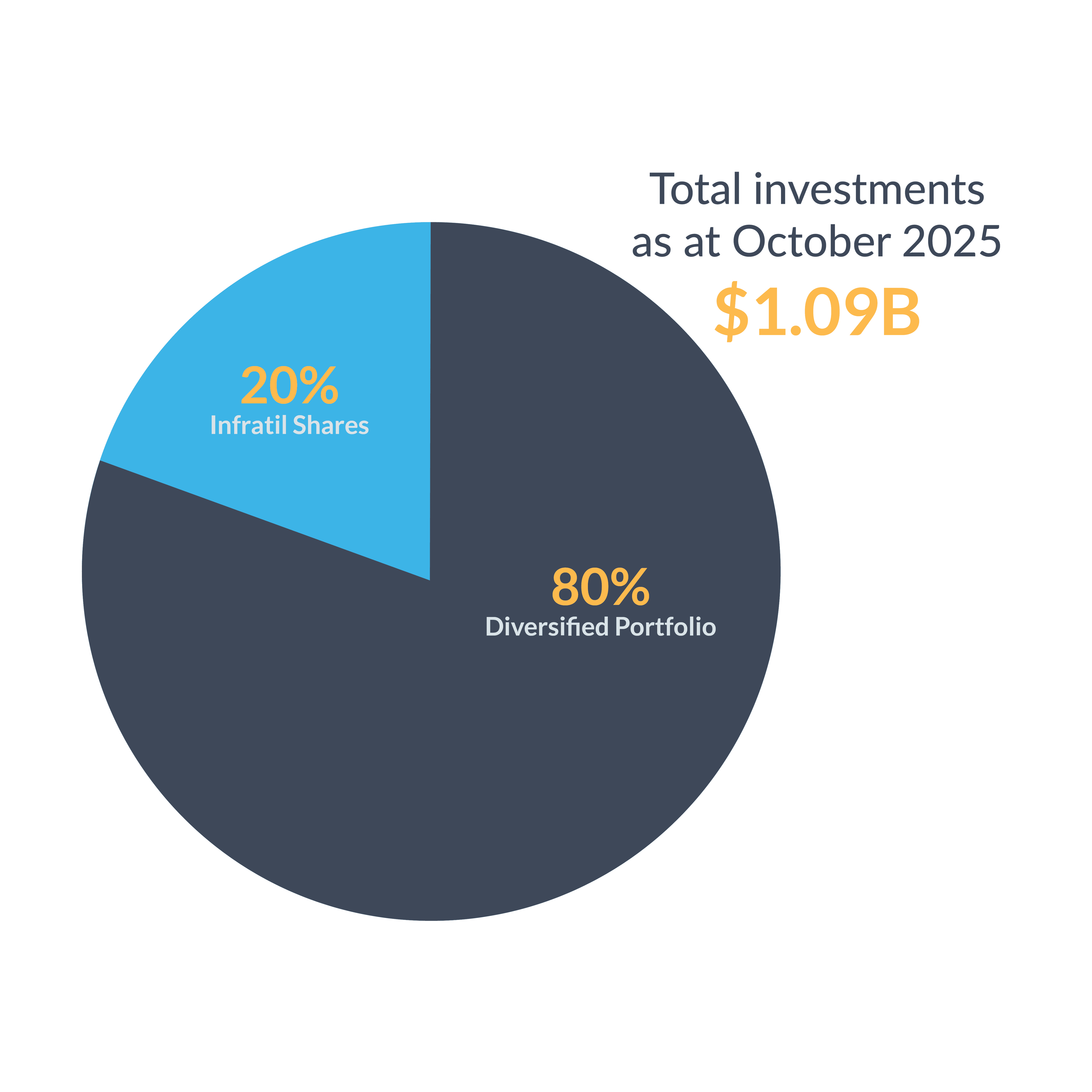

On 20 October 2025, the sale of TECT's Contact Energy Limited shares to Infratil was completed. TECT Community Trust, through its subsidiary TECT Holdings Limited, was a 4.92% shareholder of Contact Energy Limited, and as a result received $218.8M cash and 17.6M Infratil shares from the proceeds of the sale. The cash will be reinvested through the Diversified Portfolio.

The current investment profile (at October 2025) post the Contact Energy Share sale is as follows:

Infratil shareholding

TECT Community Trust (via its investment subsidiary TECT Holdings Ltd) owns 17.6M Infratil shares. For more information on Infratil visit https://infratil.com/

Our Investment Approach

Investment Principles and Beliefs

The policies, standards and procedures are documented in a Statement of Investment Policies and Objectives (SIPO) and have been set by the trustees on the basis of investment principles and beliefs.

The principles that drive the current approach are:

Asset allocation is the prime determinant of the performance of a portfolio over the long-term.

Risk and return are strongly and positively related.

Diversification can be used to reduce volatility.

Taxation and the costs of investment management can materially affect the net returns earned by investors.

The market prices of illiquid assets reflect a premium to investors (in the form of additional investment return) for bearing the risk of not being able to sell the assets on demand at their market value.

The beliefs that drive the current approach are:

The quality of the governance of an investment program has a direct effect on the level of risk-adjusted returns generated by the program.

Active management is a valid investment strategy – the trustees believe there are opportunities for active management to generate higher returns and manage risk where sufficient market inefficiencies exist.

There is an incremental return over time associated with the hedging of foreign currency risk in a New Zealand-domiciled portfolio due to the existence of an exchange risk premium.

Investors with a long-term horizon can outperform more short-term focused investors over the long-run.

Structure of Governance

The trust consists of a board of six trustees that are elected by the community for terms of four years. Trustees continuously review and adopt global best practices in the oversight of the trust’s portfolio. The day-to-day operations of the trust are managed by a Chief Executive and staff.

Trustees recognise that specialist advice and/or services may be required in the areas of taxation, portfolio management and investment management, and seek the assistance of third-party providers as required. Professional advisors must be independent of investment managers and providers of managed fund products.

The trustees have appointed Frontier Advisors as the Trusts investment advisor to provide strategic advice, to assist the trustees to develop their investment policies and to help evaluate the performance of the Diversified Portfolio and the Trust’s investment managers. Frontier Advisors has been at the forefront of delivering investment advice and technology to institutional investors for more than 25 years. They provide advice on $850B of assets across the superannuation, charity, public, insurance and higher education sectors.

Strategic Objectives

To invest the assets of the Diversification Portfolio with the aim of generating sufficient total investment returns over the long-term to:

• Meet the costs of managing the Diversification Portfolio;

• Comply with the distribution policy; and

• Maintain the real (inflation-adjusted) value of the Diversification Portfolio to maintain fairness between present and future generations.

Spending Policy

The Trustees aim to distribute in any given financial year a sum equal to 4.0% of the market value of the Diversification Portfolio.

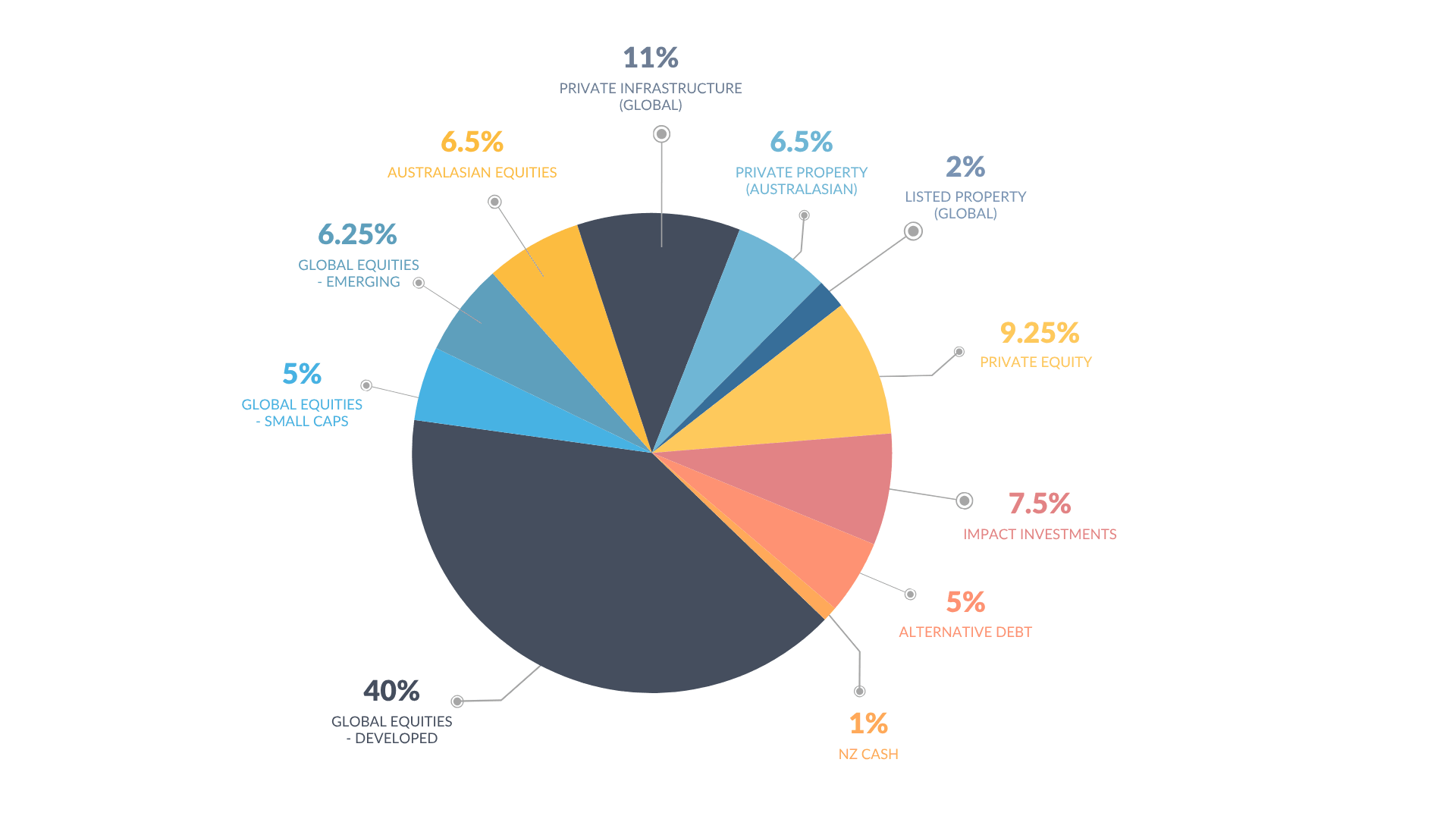

Strategic Asset Allocation

The Strategic Asset Allocation (SAA) adopted by the trustees as the target mix of asset classes to which the Diversification Portfolio will be managed, as a matter of policy, is shown below:

Asset Class | Policy Allocation |

Global Equities - Developed | 40% |

Global Equities - Small Caps | 5.0% |

Global Equities - Emerging | 6.25% |

Australasian Equities | 6.5% |

Private Infrastructure (Global) | 11.0% |

Private Property (Global) | 6.5% |

Listed Property (Global) | 2.0% |

Private Equity | 9.25% |

Impact Investments | 7.5% |

Alternative Debt | 5.0% |

NZ Cash | 1.0% |

Total Growth Assets | 100% |

*Frontier classifies the following asset classes as 100% growth: Listed Equities, Listed Property and Private Equity.

*Frontier classifies the following asset classes as 50% growth: Private Infrastructure, Private Property, Alternate Debt and Impact.

Strategic Asset Allocation Target

Spending Policy

The Trustees aim to distribute in any given financial year a sum equal to 4.0% of the market value of the Diversification Portfolio.

Current fund managers

Global Equities - Developed

Mercer | Mercer Hedged Overseas Shares Index Portfolio | www.mercer.co.nz |

Mercer | Mercer Overseas Shared Index Portfolio | www.mercer.co.nz |

Global Equities - Small Caps

Ironbank Asset Management | Ironbark Apis Global Small Companies Fund | www.ironbarkam.com/ |

Pinnacle Investment Management | Langdon Global Smaller Companies Fund | www.langdonpartners.com |

Global Equities - Emerging

Bennelong Funds Management | Skerryvore Global Emerging Markets All-Cap Equity Fund | www.bennelongfunds.com/ |

Australasian Equities

Amova Asset Management | Amova AM Wholesale Core Equity Fund | |

Salt Investment Funds | Salt Core NZ Shares Fund |

Private Infrastructure - Global

Mercer | Mercer Unlisted Infrastructure Portfolio |

Private Property - Global

Mercer | Mercer Unlisted Property Portfolio |

Listed Property - Global

Resolution Capital | Resolution Capital Global Property Securities Fund |

Private Equity

Continuity Capital Partners | Private Equity Fund No.2, No.4, No.6 and No.8 | |

Community Capital | Community Capital Private Equity Fund | |

HarbourVest Partners | HarbourVest Partners Stewardship Feeder Fund LP | |

HarbourVest Partners | HarbourVest Co-Investment VII Combined Feeder Fund LP | |

LGT Capital Partners | Crown Global Opportunities VII SCS | |

LGT Capital Partners | LGT Crown Co-Investment Opportunities IV Feeder S.C.SP | |

LGT Capital Partners | LGT Global Private Equity Evergreen Fund | |

Oriens Capital | Oriens Capital Private Equity Fund No.1 and No.2 | |

Pencarrow Private Equity | Pencarrow Bridge Fund | |

Pioneer Capital | Pioneer Capital Partners Fund IV | |

Waterman Private Capital | Waterman Fund 3, 4 and 5 and Long Term Food Group |

Impact Investments

Enterprise Angels | Fund No.2 and Fund No.3 | |

Purpose Capital Impact Fund | Purpose Capital Impact Fund (PCIF) | |

WNT Ventures | Fund No.2 and Fund No.3 | |

You Own | Bay of Plenty Housing Limited Partnership | |

BOP Housing Equity Fund | BOP Housing Equity Fund | |

Climate Venture Capital Fund | Climate Venture Capital Fund 2 |

Alternative Debt

Coolabah Capital Investments | Coolabah Short Term Income Fund | |

KKR | KKR Global Credit Opportunities Fund |

Cash

Amova Asset Management | Amova AM Wholesale NZ Cash Fund |